parker county tax assessment

817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas. Parker County Appraisal District.

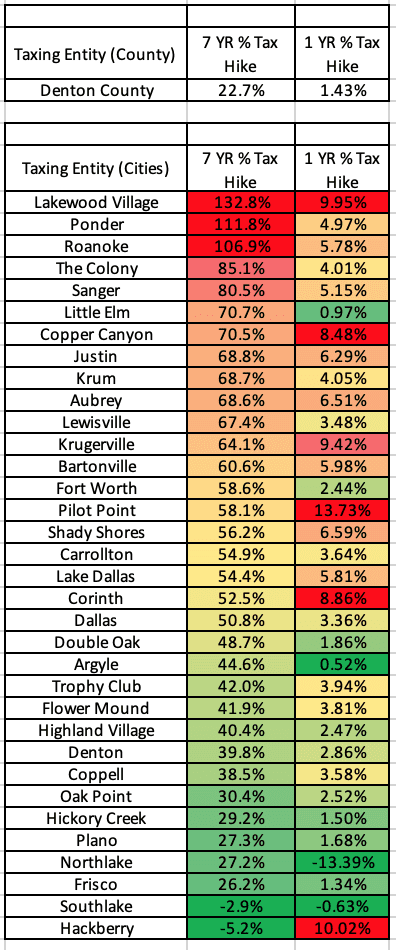

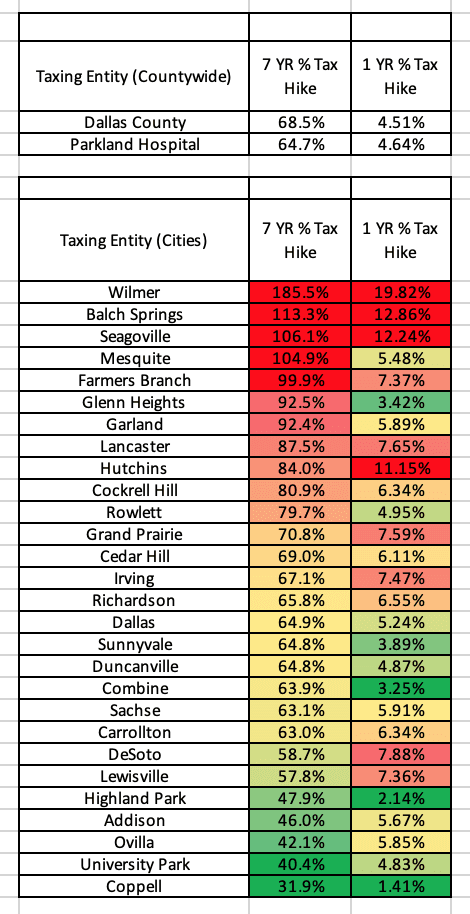

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Attorneys Approved for Appointments.

. Learn how county government serves you. Parker County collects on average 167 of a propertys assessed fair market value as property tax. Inheritance tax appraiser for the county.

The Parker County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Parker County and may. The Assessor may be reelected without limit. Parker County TX currently has 149 tax liens available as of April 13.

Watch a video explaining how the Assessors Office does business. Create an Account - Increase your productivity customize your experience and engage in information you care about. County Historical Commission Application.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office. Parker Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Parker Colorado. Tax assessments are necessary in support to the required services to TX residents.

The median property tax on a 14710000 house is 245657 in Parker County. Learn about the most recent property value reappraisal. Get driving directions to this office.

Notice of Sale - Tex. Your Douglas County Taxes. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Get Emergency Alerts from Parker County. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Parker County TX at tax lien auctions or online distressed asset sales. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Certain Tax Records are considered public record which means they are available to the public. It is the responsibility of the La Paz County Assessors Office to locate identify and appraise at current market value all locally assessed property subject to ad valorem taxes. Locating valuing and classifying all taxable property within Park County.

Parker County Tax Office Services Offered County tax assessor-collector offices provide most vehicle title and registration services including. The law mandates that all real properties are subject to taxation unless exemption is imposed. 1108 Santa Fe Dr Weatherford Texas 76086.

Parker County proclaims April 2022 as Child Abuse. The Parke County Assessor is responsible for the following functions. Property Taxes Tickets etc.

Parker County Tax Assessor Parker Tax Assessor offices are responsible to carry out the mandate of Texas in Parker county. Explore a map of where property taxes go throughout Douglas County. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest.

Learn What the Assessor Does. Tax Records include property tax assessments property appraisals and income tax records. Commissioners Court Orders Resolutions.

The County Assessor is a statutory officer of the county elected for a four year term. Collecting and reporting all values to the special districts. Effective tax rate Parker County 00161 of Asessed Home Value Texas 00180 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Parker County 3452 Texas 3099 National 2471 Median home value Parker County 214200 Texas 172500 National 217500 Median income Parker County 77503 Texas 61874.

The median property tax on a 14710000 house is 266251 in Texas. Return to Staff Directory. Parker County Assessors Office Services.

Or call 817458-9848 to receive alerts. The Parker County Tax Collector is responsible for. The Parker County Assessors Office located in Weatherford Texas determines the value of all taxable property in Parker County TX.

The Parker County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Parker County. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers Change of Address on Motor Vehicle Records. Serves as president of the Property Tax Assessment.

TAX RATE INFORMATION. The Park County Assessors Office is responsible for. Oversees a general reassessment in the county.

The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100. We maintain property ownership parcel maps exemptions as well.

Pin On Home Selling Strategies Articles

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy

Property Tax Information Sussex County

Why Are Texas Property Taxes So High Home Tax Solutions

2021 2022 Property Valuation Douglas County Government

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website

Get Best Tax Return Services At Affordable Prices Weaccountax Is A Leading Accountancy Firm For Financial Services In Income Tax Return Tax Return Income Tax

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Camp Cad Official Site Pittsburg Tx

Us Melting Pot 973x551 History Classroom Teaching History High School Social Studies

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Open Cama Solutions How Integration Transforms Property Tax Assessment Farragut

A Guide To Your Property Tax Bill Alachua County Tax Collector

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Balance Sheet Template Excel Balance Sheet Template Balance Sheet Templates